From 5 Days of Reporting to 15 Minutes in Chat

AI FinData Analyst

Conversational analytics platform that lets consultants and business users ask questions about financial data and instantly get charts, dashboards, and clear answers.

Book a Case WalkthroughA Swiss financial consultancy needed faster analysis and an easier way to share financial results with non-technical stakeholders, while meeting EU AI Act requirements.

The Challenge

Financial analysis was slow and depended on technical specialists. The team also needed automated compliance documentation for AI-generated reports.

- Financial analysis and reporting took too long due to manual workflows

- Non-technical stakeholders could not explore data without analyst support

- Hard to explain results during client calls without ready charts and dashboards

- Need to meet EU AI Act requirements for every generated output

- Repeated requests and custom reports limited how many clients the team could serve

Our Solution

Softblues built AI FinData Analyst, a conversational platform where users ask questions about financial data in plain language. The system processes the request, pulls the right data, and generates clear written answers plus charts and dashboard-style outputs. It uses a two-layer setup (data integration and intelligent processing) and six specialized agents working together to handle analysis, narrative explanations, and visualization.

- Chat-based financial analysis using natural language queries

- Automatic generation of charts and dashboard-style outputs

- Two-layer design: data integration plus intelligent processing

- Six specialized agents for analysis, explanation, and visualization tasks

- Automatic EU AI Act compliance documentation for generated reports

Built with Enterprise-Grade Technology

Goals and Objectives

The client came to us with clear objectives to transform their operations.

Faster Analysis

Speed up financial analysis from days to minutes for all clients

Self-Service Insights

Let business users get financial answers without technical help

EU AI Act Compliance

Make sure all AI reports include compliance documentation

Clear Visual Outputs

Turn complex financial data into charts for better business decisions

See the Platform in Action

From intake to completion, explore how the solution transforms operations.

Cash Flow Trend Analysis (P&L)

A user asks for cash flow trends from Profit & Loss data across multiple years. The assistant responds with structured findings, highlights patterns and risks, and prepares visuals requested in the same prompt.

Contribution Margin Recommendations

The user requests profitability analysis by product segment and category. The assistant returns clear recommendations (what to expand, what to watch) in a format that can be used directly in a client discussion.

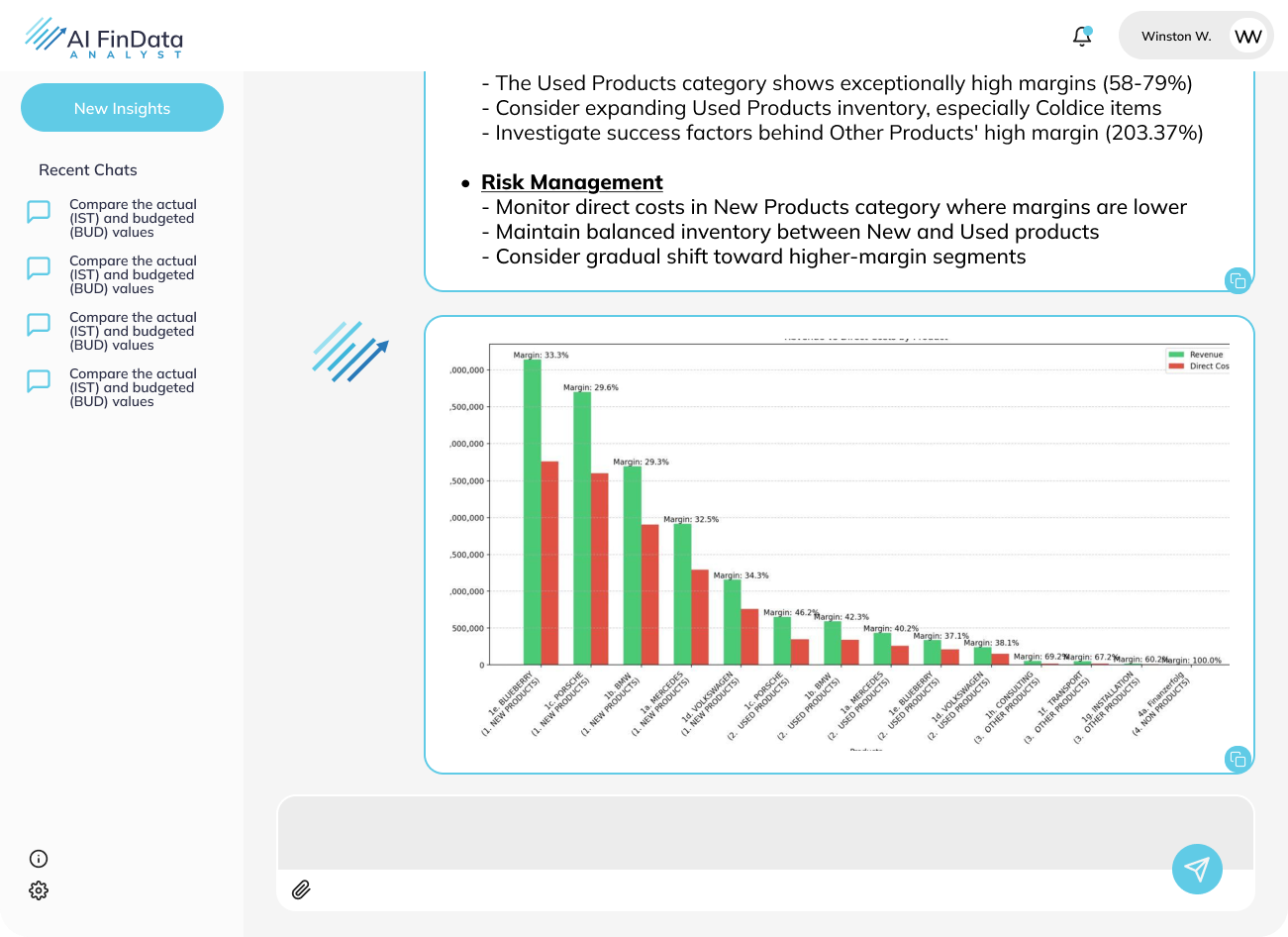

Profitability Bar Chart Output

The system generates charts from financial tables and attaches them to the response. This turns complex numbers into a visual summary that is easy to present and compare.

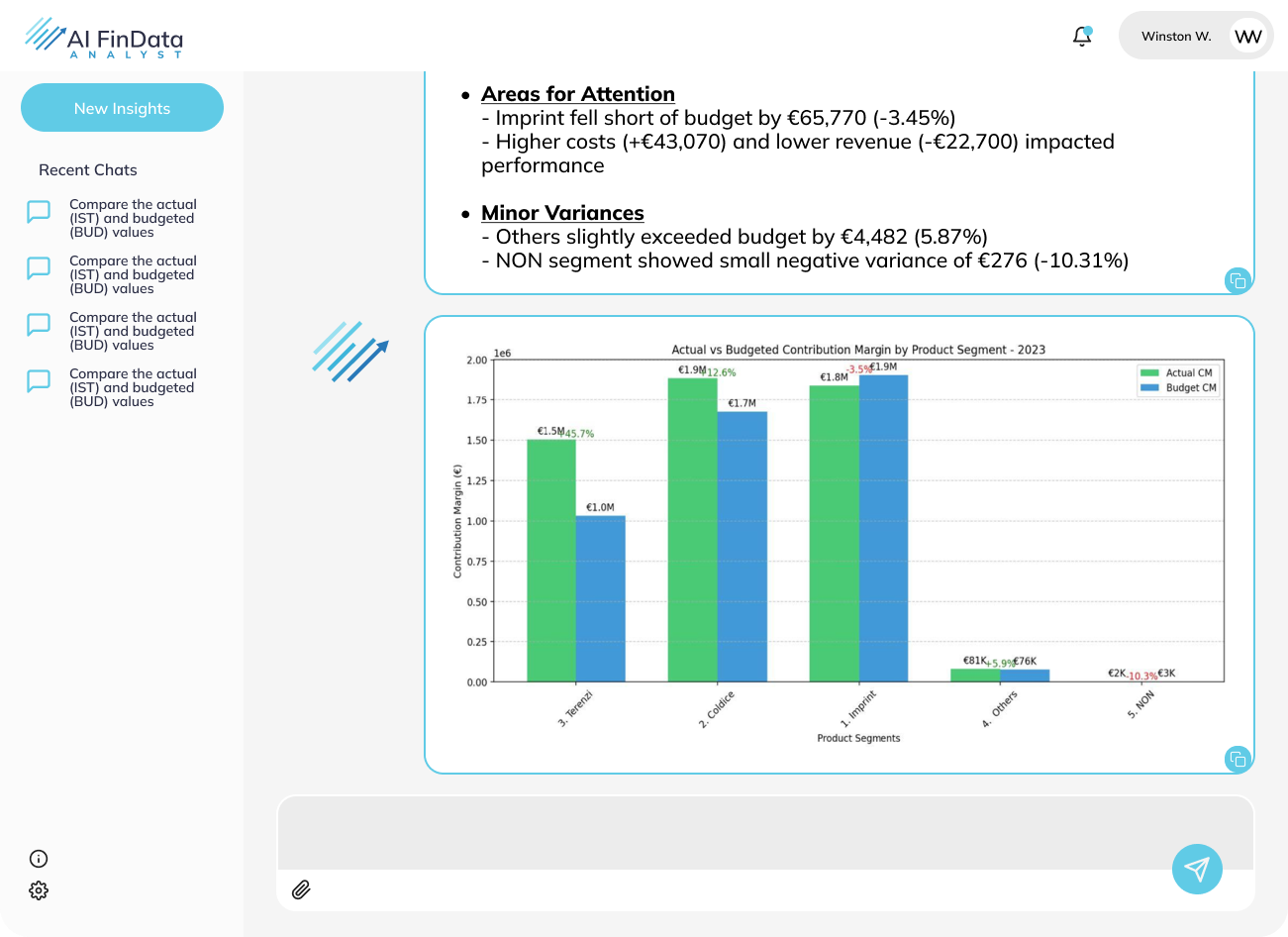

Budget vs Actual Variance Explanation

The assistant compares actual (IST) vs budgeted (BUD) values, highlights key variances, and explains what caused them (for example, cost vs revenue drivers). This reduces manual spreadsheet work.

Variance Chart for Quick Comparison

A bar chart shows actual vs budget contribution margin by segment so teams can spot where performance differs most and focus follow-up work on the right areas.

How It All Works Together

Data Integration Layer

Connects to financial data sources, prepares datasets for analysis, and keeps outputs consistent for reporting.

Intelligent Processing Layer

Interprets user questions, selects the right computations, and produces written explanations plus chart-ready results.

Multi-Agent Orchestration

Six specialized agents collaborate to handle analysis, variance checks, narrative summaries, and visualization requests.

Compliance Output Builder

Adds automated EU AI Act compliance documentation to generated reports and dashboards.

Value and Impact Delivered

Measurable improvements across every dimension of operations.

Time Efficiency

Reduced financial analysis time from 5 days to 15 minutes per client report.

Real-Time Meetings

Enabled real-time financial answers during client meetings and presentations.

Team Enablement

All consultants can now perform advanced analysis without technical training.

Compliance Confidence

Automated EU AI Act compliance documentation for all generated reports.

Business Growth

Increased consultancy capacity by 30% with the same team size.

Ready to Transform Your Financial Services Operations?

See how AI can help your organisation reduce errors, speed up processing, and improve outcomes. Let's discuss your specific challenges.

Book Discovery CallExplore Other Projects

Discover more AI solutions delivering measurable results across industries